Epilogue Announces Launch In BC!

As British Columbians, you have access to some of the most beautiful Canadian landmarks—from the majestic mountaintops of the Rockies to the endlessly blue Pacific ocean. And now, you have access to something else…

Drumroll, please. 🥁

We’re thrilled to announce that Epilogue is now available in British Columbia. All residents of our most beautiful province can now create their Wills, Enduring Power of Attorney documents, and living Wills online with Epilogue for a fraction of the time and cost it takes to see a lawyer.

Anyone who needs a basic Last Will and Testament (Will) can go online and complete one in about 20 minutes by answering a straightforward series of questions—simple as that! BC is the third province in Canada to gain access to Epilogue’s simple, fast, and affordable online Wills, which brings us that much closer to our ultimate goal of democratizing estate planning for all Canadians.

Frequently asked questions

We know people generally don't always associate the word ‘simple’ with ‘estate planning’ or legal matters of any kind for that matter. Here are some answers to some frequently asked questions to help ease your mind about important documents like online Wills in British Columbia.

How old do I have to be to make a Will in British Columbia?

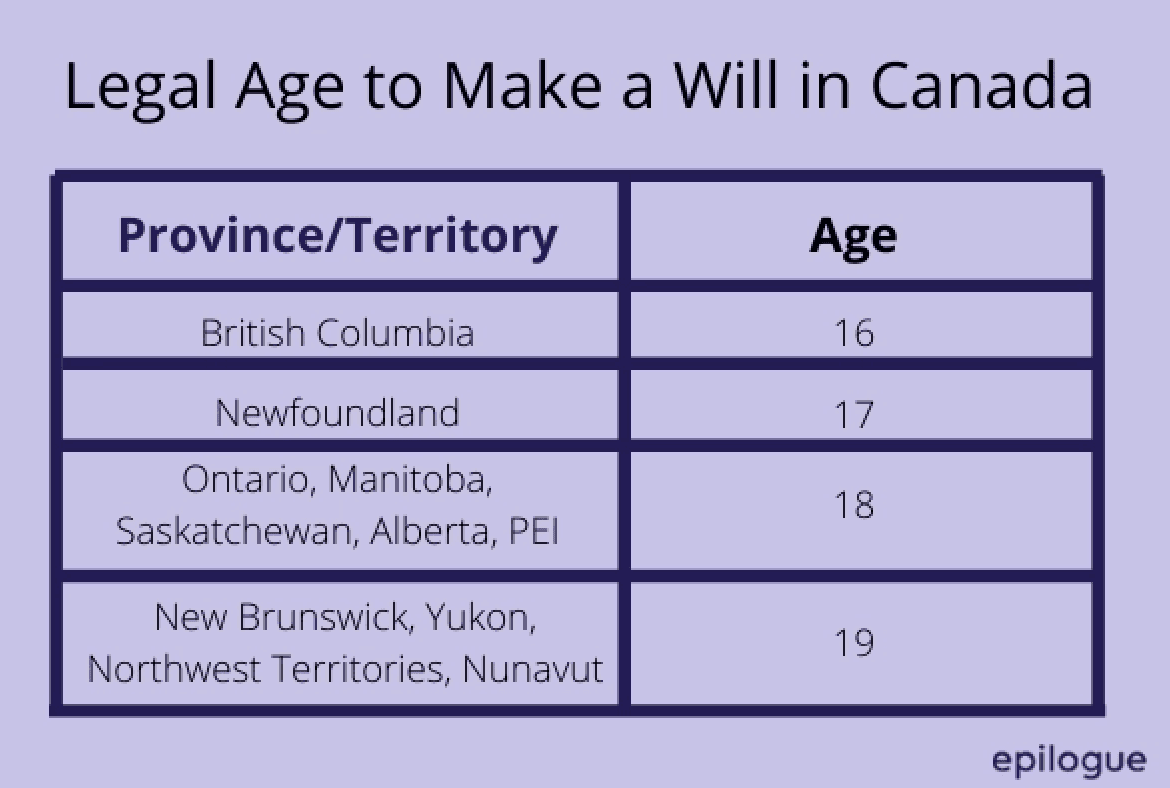

According to BC’s Wills, Estates, and Succession Act, anyone 16 years of age or older may make a Will.

That said, in order to use Epilogue we require that you be the age of majority in your province. That means in British Columbia, you need to be at least 19 to make your Will using Epilogue.

Don't you need a lawyer to make your Will?

Truth is, most people don't require a legal professional to create a Will in British Columbia, nor do you need one to make your Will valid. In BC, as long as the person making the Will is at least 16 and is 'of sound mind', they can make a legal Will. As long as the Will is printed and physically signed and witnessed by the person making the Will and two witnesses it is legally valid.

Having said that, a lawyer or notary is required to sign an Enduring Power of Attorney (EPOA). So, if you plan on creating both an EPOA and a Will at the same time this is something to keep in mind. More on EPOAs and other important documents below.

Situations where it's recommended to seek legal advice

There are a handful of instances where someone may need to consult with a legal professional to help out.

While an online service, like Epilogue, is a great solution for anyone who needs a basic Will, the following situations will require more complicated planning:

Someone wants to exclude a spouse, child, or another dependant from their Will

Someone wants to treat their children unequally under their Will

Someone is in a second marriage/common-law relationship but has children from a prior relationship

There is a family member who is receiving government disability benefits

Someone owns property outside the province that cannot be dealt with under a BC Will

Someone wants to engage in sophisticated tax planning

What is a common-law partner entitled to in British Columbia?

A common-law relationship (also called a marriage-like relationship) is a relationship where you and your partner have lived together in a marriage-like relationship for at least two years.

If you have a common-law partner, B.C. laws treat you and your partner the same way they’d treat a married couple. In the context of Wills and estates, B.C.’s laws call your common-law partner your “spouse,” and they’re entitled to the same rights as a legally married spouse would be.

What is my common-law partner entitled to if I die without a Will in BC?

If you die without a Will in British Columbia, your common-law partner would still have a right to part of your estate. The same situation plays out very differently if you live in a province like Ontario, where estate laws don’t automatically give a portion of your estate to your common-law spouse.

What happens to my kids if I die?

If you’re a parent to minor children, you can appoint a person (or persons) who will take care of your children if you pass away before they turn 19 years old. This person is called a guardian.

Ultimately, the provincial court appoints the legal guardian of your children. As long as you have a Will where you express your wishes for guardianship, the courts will generally respect your decision unless there’s a really good reason not to do so.

When it comes to the assets that you are leaving behind to your children, if you don’t have a Will in place, everything you leave them will go to the Public Guardian and Trustee to be managed until they turn 19. At that time, it will all be distributed to your children all at once.

A note on trusts

If you make a Will, the money left to your children can go into a “trust”, which means it gets managed by a “trustee” that you name in the Will. This is an opportunity to name someone you trust (no pun intended) to look after the money for your children.

You can also decide that the money should be kept in the trust until an age that is later than 19 (for example, 21, 25, or 30) if you think that would be a better time for your children to receive their inheritance.

What happens if I die without a Will in British Columbia?

Dying without a Will is called dying intestate. Without a Will, your estate is distributed according to the default laws in the province.

The rules differ depending on your situation. Here are some common ones:

A spouse and children

What everyone gets depends on whether you had your children with your spouse or with someone in another relationship.

If all your children are from you and your spouse

Your spouse gets all the furniture and $300,000 "off the top", and the rest is divided one-half to the spouse and one-half to the children.

If your children are from a prior/different relationship

Your surviving spouse gets $150,000 “off the top,” and the rest is divided one-half to the spouse and one-half to the children.

Children but no surviving spouse

Your estate gets divided evenly among your kids.

No lineal descendants

Your assets go to your parents.

No matter which way you slice it, or which stage of life you’re in, not having a Will strips away your authority to decide what to do with your own things and how you wish to protect your loved ones. That’s why it’s so important to make one.

What is an Enduring Power of Attorney?

An Enduring Power of Attorney (EPOA) is a document that appoints an individual to take care of making decisions about your property and finances if you become unable to manage them yourself. This includes things like general banking needs, paying bills, and managing investments.

The person making the EPOA is called the “Adult”. When it comes to property, the Adult has two options:

Authorize their attorney(s) to deal with the real estate if they become incapable. This can include buying, selling, and mortgaging property. In this case, the Adult has to sign the document in the presence of a lawyer or notary and have them certify their signature.

Not authorize their attorney(s) to deal with real estate. If this is the case, they don’t need to have their signatures certified and can choose to sign their EPOA in the presence of a lawyer/notary or simply two witnesses.

In B.C. the attorney(s)'s signature is also required for a EPOA.

What is a Representation Agreement and do I need one?

A Representation Agreement is a document that appoints someone to make personal health care decisions should the “Adult” (the person who wants their personal/health care managed) be unable to care for themselves.

The agreement must be signed in the presence of one lawyer/notary, or in the presence of two witnesses not of the legal profession.

Unlike other provinces, in B.C. the Representatives also must sign the agreement; however, their signatures do not need to be witnessed.

When completing their planning, most people create and sign a Representation Agreement at the same time they make their Will since wishes relating to personal/health care are deeply personal and it’s the only way to make sure your loved ones know your wishes and that they will be followed even when you are unable to express them yourself.

What happens if I own property outside of British Columbia?

If you own property in a province other than British Columbia, it’s a good idea to go to a lawyer for advice on how to write your Will. Other places might have different rules about estates—for example, they could require that specific types of property be left to specific people, and override what you want to say in your Will.

If you own property outside of Canada, you should also talk to a lawyer who specializes in that specific jurisdiction.

Where do I register my Will?

BC is one of the few provinces that has a provincial registry for Wills. Once a Will is created, a person (or their lawyer) should register their will online with the BC Vital Statistics Agency Wills Registry.

I’m ready to get started! What do I do next?

To celebrate our launch in British Columbia, we’re offering everyone 20% off their estate planning documents with Epilogue! Just use code BC20 at checkout.

No need to procrastinate any longer, it only takes about 20 minutes to make a legally binding Will online and get peace-of-mind knowing you’ve protected your family members and loved ones. Plus, you can log in to your dashboard and make any changes or updates anytime, free of charge.

Still have questions?

Feel free to reach out to us at any time via live chat, phone, or email and we'd be happy to help!