Leaving A Legacy In Cyberspace

We live in a digital age. Since the advent of the World Wide Web about 30 years ago, much of our lives have moved online—from how we communicate to where we save our photos to how we shop for groceries. Most people spend an average of 144 minutes a day on social media and some even top 240 minutes per day!

Despite the fact that so much of what we do hinges on online platforms, we’re not really thinking about protecting our digital assets. And that’s a problem.

In this post, we’ll break down exactly what digital assets are and why it’s so important to have measures in place to protect them (and in turn yourself).

What is a Digital Asset? What is a Digital Legacy?

Digital asset = any electronic record. We like to think of them as our memories, money, and records – just in a digital format instead of paper. Digital assets are anything that leaves a digital footprint and includes things like:

Social media & dating app profiles

Email & Cloud accounts

Blogs or web domains

Forums and chat room history

Online gaming accounts

Digital accounts associated with managing our households (e.g., heat, hydro)

Loyalty or reward points

Ad or click revenue

E-books or audiobooks

Crypto Assets and non-fungible tokens

Digital legacy = all the digital information that will still be available online following your death. Think of your LinkedIn profile, dating profile, and your crypto assets all coming together to paint a holistic and lasting picture of who you were.

Just Like Physical Assets, Wills Must Also Include Digital Assets

The only way to legally document your wishes for your assets is in a Will. But unfortunately, according to the latest data 51% of Canadian adults don’t have a Will at all and 15% have one that is out-of-date.

Given that over half the country isn’t even thinking about their physical estates (homes, bank accounts, money, etc.), it’s no surprise that the vast majority of us also aren’t thinking about our digital estates.

One big reason for this is because we often don’t think of our digital assets as having any financial value. But, digital assets can be worth quite a lot. According to a recent report, the average Canadian accumulates over $10,000 worth of digital assets!

Another thing to consider is the sentimental value of digital assets. For example, what will happen to your online photo albums after you’re no longer here?

It’s time for a mental shift in thinking about how we want these assets documented, protected, and managed when we are no longer here to manage them ourselves.

Today’s Executor is a Digital Executor

When you complete your Will and estate planning documents, one of the most important things you’ll do is appoint an Executor (the person responsible for carrying out your final wishes).

In today’s digital age, you’ll need to prepare your Executor on how you want them to deal with your digital assets. This can include pre-planning, instructions, tax planning, legal advice, and access to qualified technical support.

Why Should I Plan For My Digital Assets?

By their very nature, digital assets are challenging to locate and access because they are…well… digital. Unlike some physical assets, there is likely no paper trail for your Executor to follow. And just like physical assets, digital assets require pre-planning to be transferred successfully during estate administration.

Not planning for your digital estate also increases the risk to your physical estate. Think about it: a lot of physical assets are managed digitally by systems that are password protected.

Traditionally, an Executor would know which assets a deceased person owned based on a paper trail. But much of what would be documented physically on paper is likely password-locked in a mobile phone, tablet, laptop, or computer in today’s digital age.

What Happens if I Don’t Plan For My Digital Assets?

With cybercrime and identity theft on the rise, you leave your entire estate vulnerable if your Executor can’t address your digital assets after you pass away.

The first step to doing this right is with a Will. When there is no Will, the court must appoint an Executor, which can take time, leaving a deceased person’s estate exposed to a potential hack.

The problem is that most Wills don’t fully account for digital assets. After all, we are the first generation that has to contend with this issue!

Here’s How to Best Protect Your Digital Legacy

Every adult has at least a few digital accounts and should prepare estate planning documentation for them. It’s important to consider what you want to happen with your digital footprint after you’re gone and save it in a safe place so your Executor is clear on your wishes.

When preparing to put together your digital estate plan together, ask yourself questions like:

Do you want your social media life to live on?

Do you want your Executor or family to be able to read your emails?

Do you have content or a browsing history you’d rather just disappear upon your death?

Do you know who will get your loyalty points?

Do you have an unregulated cryptocurrency where the Executor will need special technical instruction on how to access (note: there is no central authority for password resets with cryptocurrencies.)

Will you have an inventory of digital assets accessible to your Executor at the appropriate time?

An excellent first step to healthy IT hygiene is to update security/privacy settings and delete accounts you no longer use.

Generally, most of us have yet to become fully aware of the extent and complexity of our digital assets. That’s why it’s essential to start thinking about it and having these conversations now so you can take control of your digital afterlife.

What Happens to Your Social Media Accounts When You Die?

How many social media accounts are you on? Whether it’s Facebook, Instagram, Twitter, Snap, Reddit, Medium, or TikTok, they act as an extension of yourself, filled with personal images, conversations, and memories that will live on much longer than you will. And for some of you, they also represent a revenue stream.

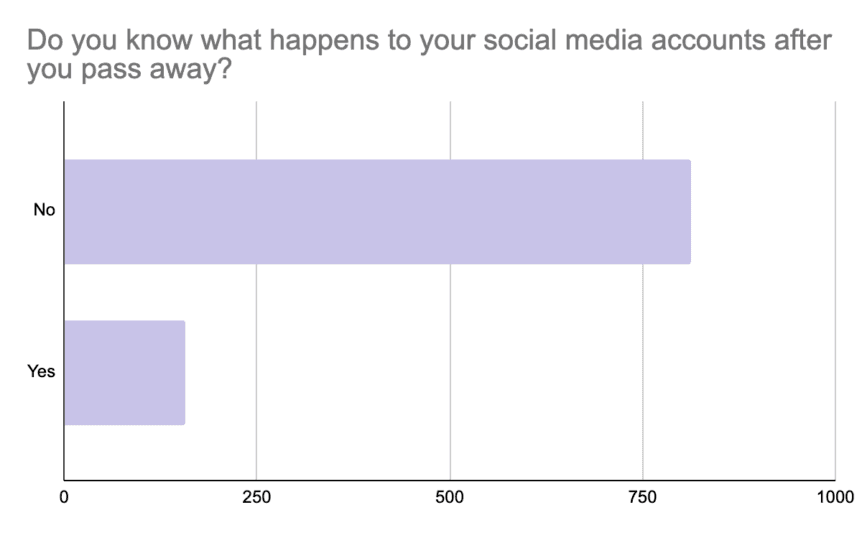

So, how do you want these assets handled after you die? This isn’t a question most of us have had to face. According to a recent survey we ran, over 83% of respondents who use social media have no idea what happens to their accounts after they are no longer here.

Social media platforms have only been around for a generation. By 2130, there will be more dead people on Facebook than live ones. The time to pre-plan your social media legacy is now.

Legacy Planning for Your Social Media Accounts

Some (but not all) social media platforms have legacy planning features that allow you to name a legacy contact and/or choose how you want your accounts handled after you die.

For the ones with pre-planning, you just have a couple of options when it comes to your social media accounts:

You can turn them into a memorial; or,

You can have them shut down.

Since these features are relatively new, they haven’t been widely adopted yet. According to the same survey mentioned above, only 8.2% of social media users have actually used any of the legacy planning features available.

If you don’t specify your social media wishes, it might lead to an undesirable digital afterlife. After all, the internet is forever, but humans are not.

Sharing Passwords is Not the Solution

We can’t stress this enough: Simply writing your accounts’ passwords down is not an acceptable approach. The best way to pre-plan for significant digital assets is to assume that passwords will not be available for whatever reason: legal, technical, or otherwise.

Here are a couple of reasons why:

What governs most of our online accounts is the Terms of Service. This puts the provider in the driver’s seat about what happens on death. Most service providers do not allow you to share your passwords. The implication is that your Executor may not have the right to use them and expose themselves to unintended liabilities.

Practically speaking, passwords are unreliable. They can get written down incorrectly or expire. Plus, sometimes, they might require secondary authentication steps for access.

In our opinion, relying on passwords is insufficient estate planning for significant digital assets.

Instead, Make a Free Social Media Will

Since many social media sites are yet to provide a full suite of pre-planning features, the best way to leave the digital legacy you want is through a Social Media Will – yes, there is such a thing!

A social media let’s you:

Craft a final post to be shared after you pass away

Select a specific profile photo to be used for your memorialized accounts

Choose to have specific accounts deleted forever

Take time to consider what you would want for your social afterlife, and most importantly – share these wishes. Make your FREE Social Media Will today at Epilogue and protect your legacy.