By The Numbers: Are Canadians Prepared For Death?

According to a number of recent surveys, as many as three-quarters of Canadian adults do not have a Will that reflects their current circumstances and wishes.

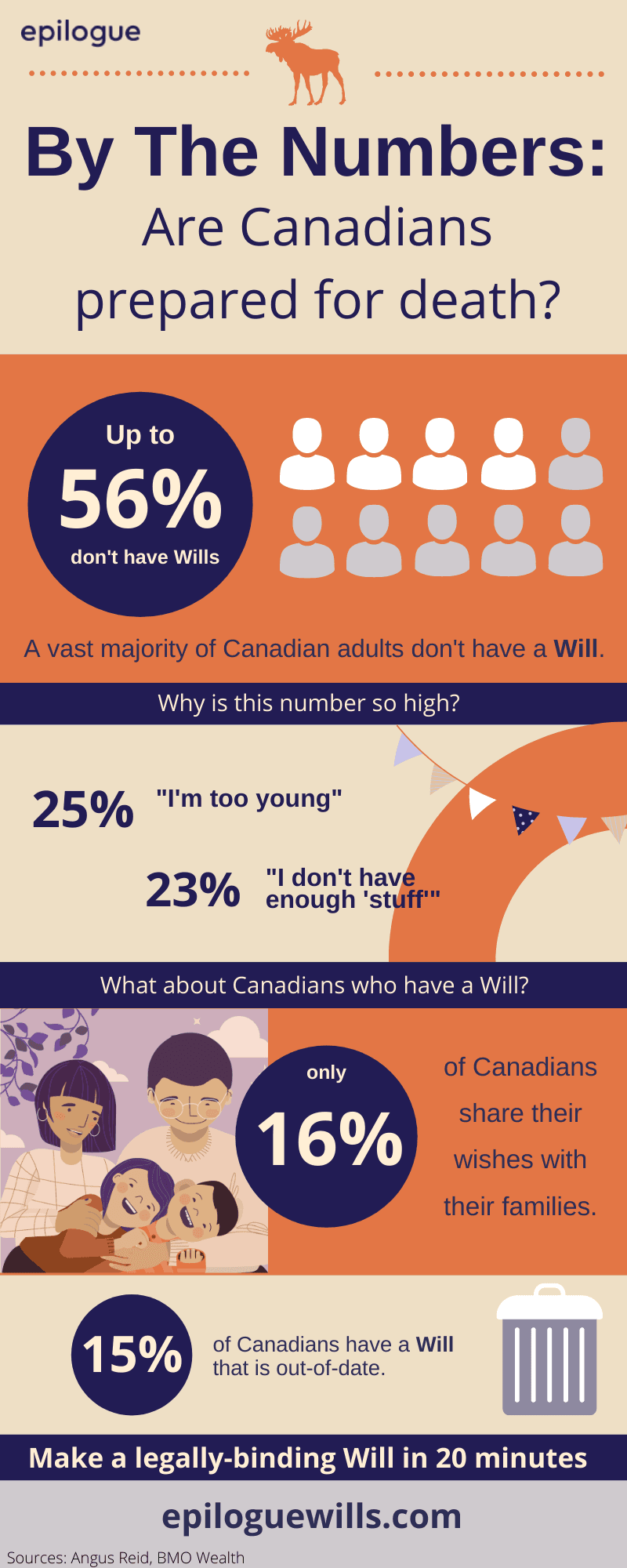

When you break the numbers down, about 56% of Canadian adults don't have a Will at all, and as many as 15% have a Will that is out-of-date. This means that a majority of Canadians don’t have a Will that is going to properly take care of their loved ones after they’re gone. If we focus on millennials, that figure jumps to a startling 88%.

Why don’t Canadians make Wills?

Canadians are awesome at lots of things—like hockey and saying “sorry.” So, why are we so unprepared when it comes to planning for our loved ones after we're gone? While everyone’s life circumstances are unique, there are a few common reasons people put off making a Will.

Many Canadians don’t think they need a Will

Lots of Canadians don’t have a Will because they simply don’t think they need one. One-quarter of Canadians think they are too young to worry about making a Will, while another 23% believe they don’t have enough assets to make Will-writing worthwhile. These numbers are surprising when you consider the fact that the average Canadian will leave an estate of almost $380,000.

A common misconception is that Wills are only important for people who are married, have children, and own significant assets. But this simply isn’t the case. The truth is, every adult should have a Will.

The main benefit of having a Will is that it puts you in control. A Will gives you the power to decide who gets what: money, property, and other assets. It really doesn’t matter how much or how little you think you have. If you don’t make a Will, the government makes these decisions for you.

When you make a Will, you get to choose a trusted friend or family member to speak for you when you’re gone. This person is called an executor and they have the legal right to take control of all your assets after you’re gone (think bank accounts, car, laptop, cell phone...literally everything.) Your executor’s job is to carry out the instructions you left in your Will. But if you die without a Will, appointing an executor can be a time consuming and expensive process. And it all too often leads to arguments and tension between family members.

Too expensive and time-consuming

Finances are a big consideration as well. Eighteen percent of people surveyed said they don’t have a Will because they feel it’s too expensive. In households earning less than $50,000 per year, 22% of people cite cost as the main reason for not getting a Will. Another 5% hold off on Will-writing because they think it’s too time-consuming.

This is hardly surprising. Until recently, the only way to get a properly drafted Will was to go to a lawyer. This process typically involves finding a lawyer, attending multiple meetings at the lawyer’s office, and waiting weeks or months to receive and finalize your documents. To top it all off, the vast majority of lawyers charge hourly, with rates starting at around $250/hour!

Discomfort and fears around estate planning

Let’s face it: Death is an uncomfortable topic. No one wants to think about dying and leaving their loved ones behind. And for 8% of Canadians, that’s the main reason they haven’t made a Will.

Why is death and dying so hard for us to talk about when it’s one of the only things every single human being has in common? For many of us, estate planning never found its way into the dinner-table conversation. More often than not, parents don't discuss their estate planning with their children.

Will creation and the topic of death is triggering for some people. It tends to drum up certain fears:

Fears that talking about estate planning will incite family conflict.

Fears that these types of conversations are “bad luck” or “tempt fate.”

Fear of talking to a lawyer about their personal wishes.

Fear of having to swim through a sea of legal jargon!

Considering all this, it’s no wonder so many Canadians have not yet taken the critical step of making a Will. But, in the case of estate planning, ignorance is not bliss. There are some seriously negative consequences if you die without a valid Will.

What happens if you die without a Will?

If you die without a Will, it’s called dying “intestate.” When someone chooses not to make a Will and dies intestate, they give up a lot of control over what happens after they’re gone. Without a Will, you don’t have any legally appointed beneficiaries, guardians, or executors.

Dying intestate means you don’t get to choose who receives your money, property, and other assets. Instead, everything gets distributed according to Ontario's provincial laws. Sometimes, a spouse ends up with all of the assets when the person really wanted something to go to their parents as well.

What often shocks people is that, under the laws of most provinces, a common-law spouse or partner is not entitled to receive anything when there is no Will. Even if the couple had been together for many years! What’s worse, there have been cases where the deceased’s family got nothing because everything went to the person’s estranged spouse!

If you’re a parent of young kids, another important decision you make in your Will is choosing someone to be their guardian if you pass away. If a guardian isn’t appointed in a legal Will, it’s up to a court to determine who looks after any minor children that are left behind without any guidance from that child's parents.

As mentioned, your executor is someone you choose to carry out your wishes after you’re gone. When there is no Will, there’s no executor. It can often take months before the court appoints someone as the executor. Until that time, it can be difficult for the family to access any of the deceased’s assets.

Planning for your own death can be hard to think about. But you should ultimately be the one to decide how your final affairs are handled. And your loved ones deserve to be taken care of the way you want them to be (not the government). Taking the time now to plan out how to distribute your assets–and who will care for your loved ones–will save your family time, money, and headaches down the road.

Now for some good news: it’s never been easier and more affordable to make a Will

Yup, the general consensus seems to be that Canadians think making a Will is a bit of a bummer. While it may seem unpleasant, time-consuming, costly, and even unnecessary, it’s absolutely essential for Canadian adults to have an up-to-date Will.

The good news is times are changing and estate planning is changing too! If you just need basic estate planning documents to protect your loved ones, it’s never been faster, easier, and more affordable. There are now convenient online solutions that let you make a legally-binding Will and Powers of Attorney without leaving the comfort of your own home.

Epilogue helps you create the documents you need, so you can relax and get back to whatever it is you’d rather be doing. If you have 20 minutes today, you have time to plan for your future.